This hire purchase calculator will allow you to see the true cost of your hire purchase over the lifetime of the contract. Interest rates are calculated as a percentage of the loans value so if you can find lenders offering lower interest rates the better it would be for you.

Hire Purchase Meaning Agreement Calculation What Is It

Balance payable to bank 90000 x 1 7 x 00285 107955.

. The interest rate that the bank offers you is 3 for 5 years. Most Hire Purchase car finance interest rates range from 4 to 9 and these figures are manageable for most people looking to finance a car. Therefore the company must recognize a lease liability and a corresponding asset.

It is popularly used in personal loans and hire purchase car loans. The monthly payment over 3 years is equal to 200. The double entry will be.

HP Interest in Suspense. Calculating the hire purchase loan. The journal entries will be as follows.

100 f I r Pt Where. This hire purchase calculator will show the principal and interest costs per month to show the level of extra payments on top of the items price that you will be paying as well as the size of the monthly principal payments. In the account tab of the Payment transaction.

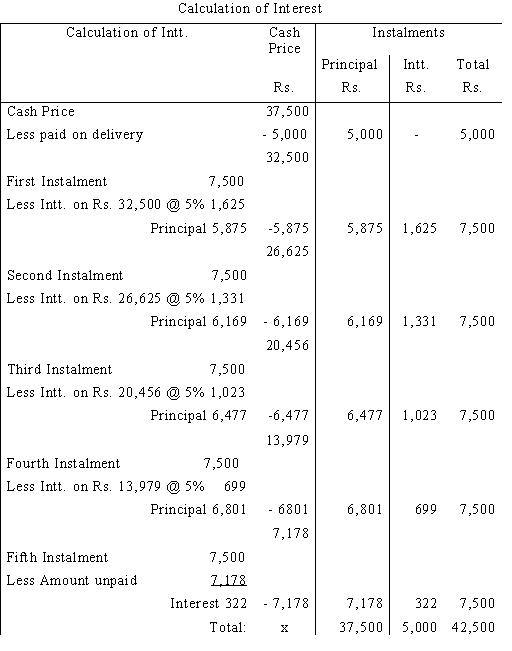

That means you are paying interest of RM13500 over the course of 5 years. Most hire purchase deals are done over 36-60. Annual Instalment 30000 3 10000 plus interest In this question interest shall be calculated every year and shall be added to 10000 to find total amount of instalment paid.

Total Payment RM. 20000 and balance payable in 3 equal annual instalments plus interest. Use our HP Hire Purchase calculator to get a full breakdown of your HP deal.

Here is the video about calculation of interest on hire purchase systemThis is the continuation video on Hire purchaseIn the previous video we have seen in. The hire purchase agreement was developed. With hire purchase you hire an item a car a laptop a television and pay an agreed amount in monthly payments.

The monthly instalment is calculated as follows. Say for example youre taking out a personal loan of RM100000 with a flat rate interest of 55 over 10 years. You do not own the item until you have made the final payment.

While simple interest does not take this into account. EFFECTIVE RATE OF INTEREST FORMULA where n no. Rate of Interest 9 pa.

Other analogous practices are described as closed-end leasing or rent to own. Calculate the interest on the amount you are borrowing Divide the interest by the total number of. Assuming interest rate of 285 percent 7 years 84 months tenure and 90 percent financing margin for a vehicle costing 100000.

A low interest rate means more affordable monthly repayments. A company ABC Co enters into a hire purchase agreement to acquire an asset. A Total amount after interest S Starting amount after.

The objective is to get cell E10 to show a value of nil by changing cell C1 so as to work out the interest over the life of the lease that will be recognised in profit or loss. You pay a 10 downpayment which is RM10000 and apply for an RM90000 loan. Cash Price Rs.

Hire purchase is calculated using the simple interest formula and interest is only calculated on the amount owing. Hiring Period in Years Calculated Interest Charges RM. HIRE PURCHASE FORMULAS TOTAL AMOUNT PAID DEPOSIT INSTALMENTS TOTAL INTEREST PAID TOTAL AMOUNT PAID ORIGINAL PRICE OF ITEM The interest rate being charged under a Hire Purchase Agreement is calculated using the SIMPLE INTEREST formula and is called the ANNUAL FLAT RATE of interest.

Calculate total balance payable to bank. The more repayments there are the closer it is to double the flat rate. The cash value is Rs 9 000.

If you do not know your interest rate enter your monthly payment and we can. We will calculate your payments total costs total interest charged and provide a schedule of payments detailing each month of the contract to show you the remaining balance at each payment. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

Assuming the monthly repayment is 63500 of which 28900 is the HP interest and HP Principal repayment is 34600. Original Loan Amount x Number of Years x Interest Rate Per Annum Number of Instalments Interest Payable Per Instalment. Calculate monthly hire purchase repayment.

Assuming you are buying a car that cost RM100000. As a general rule the price of a Hire Purchase is calculated as follows. Personal Contract Plans PCPs are a type of hire purchase agreement.

After sorting out the initial contract the company gets the asset. Hire purchase is calculated using the simple interest formula and interest is only calculated on the amount owing. Interest Rate pa.

Amount financed x Rate x Years RM50000 x 10 x 5. A S 1 in Where. Here is the video about How to calculate Interest on Hire Purchase system In this video we have discussed basics concepts of Hire purchase system in account.

This would be your flat rate interest per instalment. Initial payment 10000 30 3000 Total monthly payment 200 36 months 7200 Interest 3000 7200 10000 200. Amount financed Total interest on amount financed.

A hire purchase also known as an installment plan or the never-never is an arrangement whereby a customer agrees to a contract to acquire an asset by paying an initial installment and repays the balance of the price of the asset plus interest over a period of time. To use the Goal Seek function go to the Data tab at the top of the Excel workbook and then into What-if Analysis and select Goal Seek. Monthly loan repayment 10795584 128518.

Debit Hire Purchase Creditor account Balance Sheet. Of instalments over the life of the contract annual flat rate of interest charged in contract The effective rate of interest is roughly about twice the flat rate of interest. Calculates the present value of the lease payments to be 100000.

1st instalment at payment module. What is the formula to calculate amount. 50000 Down payment Rs.

Hire Purchase System Part I Wikieducator

Add On Interest Meaning Importance Calculation And More

Hire Purchase System Part I Wikieducator

How Is The Price Of A Hire Purchase Calculated Osv

Accounting For Hire Purchase Accounting Education

Hire Purchase Meaning Agreement Calculation What Is It

Discount Factor Formula How To Use Examples And More

Finance Hire Purchase Math Showme

Flat And Reducing Rate Of Interest Calculator In Excel Free Download

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase Meaning Agreement Calculation What Is It

Rate Simple Interest For Hire Purchase

Effective Interest Rate Formula Calculator With Excel Template

Calculation Of The Effective Interest Rate On Loan In Excel

How To Calculate Flat Rate Interest And Reducing Balance Rate

2 Hire Purchase Accounting Calculation Of Interest When Rate Of Interest Is Not Given Kauserwise Youtube

- cara buat spaghetti bolognese

- bilik sewa kuala terengganu

- menanti februari episod 4

- temberang ayda jebat mp3

- resepi aya masak merah

- maybank application form

- kalung pria emas putih

- undefined

- how to calculate hire purchase interest

- polis evo 2 free download

- koleksi nama bayi perempuan terkini

- taman barakah tanah merah

- modul matematik tahun 4

- 100 muka surat pertama pdf

- resepi burger sedap

- clipart hitam putih bintang

- kompleks sungai buloh

- contoh design kad ucapan

- badan bayi bintik bintik merah

- crude palm oil news